Brand Research: sweetgreen’s Market Planning & Strategy

One Key Insight

Sweetgreen sells made-to-order healthy salads and bowls from ~200 primarily urban locations in high-population, high-employment, very high income areas with a loyal niche in the QSR space but a challenging path to grow at scale.

Who They Are

Sweetgreen, founded in 2014 in D.C., is a fast casual restaurant serving made-to-order healthy bowls and salads.

They were an early mover and innovator in the now-popular segment of clean ingredients, transparent product sourcing, and prepared fresh in front of you to-go meals.

Think a Chipotle-like ordering experience but with a greater focus on vegetables and greens.

The brand has grown to over 200 open and coming-soon locations and annual revenue of $470M in FY22, with ~$2.9M average unit volume for mature stores. Sweetgreen went through an IPO in November 2021, albeit with a share price that has stumbled in the time since going public, down from a high of $53 at IPO to a current price in the mid-$8’s.

200+ locations / $470M revenue / $2.9M revenue per location

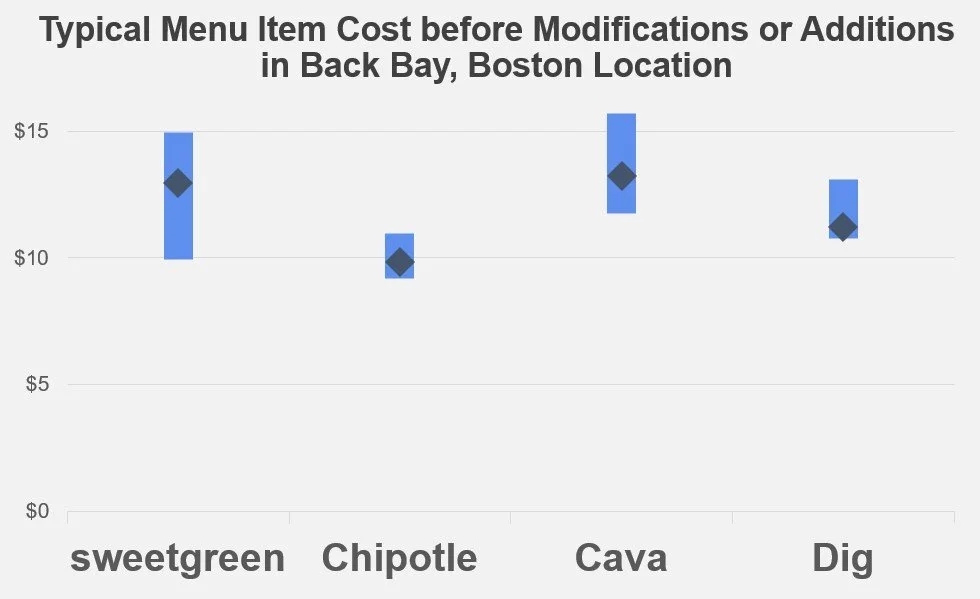

Clean, healthy ingredients come at a cost, and sweetgreen isn’t the cheapest option in town.

A typical bowl in Boston’s Back Bay neighborhood will be ~$12-$15 before taxes, modifications, or additions

A Chipotle bowl down the street will be ~$9-$11

In the competitive market for urban lunch spots, even a dollar or two difference can be a large perceived markup to convince customers to go premium.

Over the last 9 years, sweetgreen has carved out a niche with high-earning, health-conscious millennials, and their location strategy reflects this (more on that later).

Last to note is that digital is a large part of their strategy, more so in the last 3 years as people moved from in-person to online ordering. Digital as a percent of revenue - or in other words, the percentage of revenue derived from digital orders - was 61% overall (app, website, third-party providers) and 41% from their own channels (app and website only).

Where They Are & Who They Target

The location profile of the business is fairly straightforward - dense urban areas in large cities. Chicago, D.C., and New York City all light up on a density map of current locations and the remaining locations all tie to major metros like Chicago, Miami, Tampa, Dallas, Houston, and more.

By state, New York has the most locations (41 - mainly NYC) followed by California (36), Illinois (21), and Massachusetts (21).

Number of Locations by State

As a premium brand, the company needs high paying jobs and high earning professionals to be able to value and afford their product, and the location profile surrounding shows good product-market fit for this audience.

Within one-mile of a typical sweetgreen location, there is:

~35,000 population

~50,000 jobs (as of 2019)

Household income of ~$120,000-$130,000

5% 5-year population growth

73% of adults with a bachelors degree or higher

These numbers reflect a target profile that is very high income - almost twice the US average - and well educated with very high density of employment and population.

There are nearly 100,000 potential customers on any given day just from residents and workers. The effects of work from home may bring that number lower, along with people that both live and work in the one-mile radius (likely a small number), but there’s also tourists, universities, sports venues, and other nearby attractions that would bring potential customers into these urban areas.

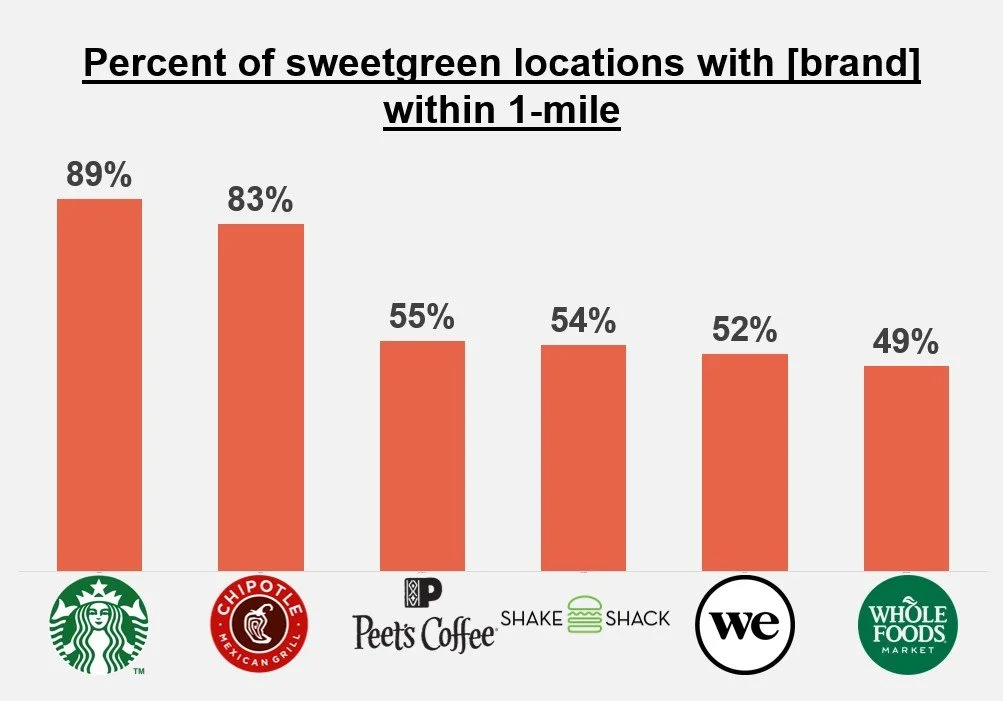

Brands that also commonly operate in the areas where there are sweetgreen locations include Starbucks, Chipotle, WeWork, and Whole Foods, among others:

Analysis of Foursquare Places data for select chains.

The Strategy & What Comes Next

As of early 2022, sweetgreen shared a vision to double the number of locations in 3-5 years and was looking toward 1,000 locations by the end of the decade.

This is an aggressive - and questionable - goal. To reach 1,000 locations means being a mass appeal product. Of the ~45 restaurant chains that have exceeded that threshold, none would be considered a premium priced offering in the way that sweetgreen is.

Simply put, there aren’t enough available locations in the US with sweetgreen’s target location profile to sustain that number of locations. The vast majority of Americans cannot or will not pay $15+ for a dish regularly, and of those that will, many of the current locations reach them.

This leaves the brand with a couple key areas for growth:

Continue modest location expansion with the current market strategy

Consolidate the market for salads

Acquire an alternative food & beverage brand that serves similar health-conscious consumers

Continued Location Growth

Building density in current areas and moving into new markets continues to be a viable short-to-medium term growth strategy.

There are no locations in primary cities like:

Phoenix, AZ

Seattle, WA

Portland, OR

…or secondary cities like:

Raleigh-Durham or Charlotte, NC

Orlando, FL

Las Vegas, NV

Salt Lake City, UT

Likewise, continued density of current cities remains a growth area.

There are 5 locations in greater Atlanta but a metro area population of 4.5M

There are 8 locations in Houston with a metro population of 7.1M

There is only 1 active and 1 coming soon in greater San Diego, CA

There is only 1 location in high-income Connecticut towns (commonly NYC commuter cities)

A sampling of potential new markets with no current locations.

The runway on the current strategy exists - continuing to open stores in high-income, high-population metro areas - but it seems unlikely that there are 800 more highly successful locations available given what makes them successful today.

Consolidate the Market

Outside of sweetgreen, the market is largely fragmented for health salads. Competitive consolidation - especially in markets where the company doesn’t operate and with a slightly down-market focus - could be a rapid growth opportunity for the brand.

Companies like Chopt Salads (~80 locations) and Just Salad (~70 locations) represent platforms to grow in new and existing markets, both of which hit similar but not-quite-as-high-end price points.

The brand will have to move down-market in some capacity to reach 1,000 locations if they choose to continue focusing only on the clean made-to-order clean eating market. Sweetgreen can’t move down-market with their current product because doing so would dilute their brand value. Clean, fresh ingredients cost a premium. Choosing cheaper products goes against their brand, so it seems an unlikely option.

Buying one of these brands - or standing one up themselves (more intensive and challenging) - could present an alternative brand name for regional growth in non-core metro areas.

Acquire An Alternative Market Like-Minded Brand

A common framework for growth is find new customers or sell more to current customers. Either of these can be achieved through acquisition. Moving into a new category like breakfast or alternate healthy choices (smoothies, juices) can help them continue to grow with their current core customer and/or be introduced to new customers.

A couple examples of what this might look like include:

Moving into the breakfast market with a premium coffee chain like Blue Bottle (owned by Nestle)

Acquire a health-conscious juice or smoothie bar

Ultimately, location growth doesn’t have to come from the sweetgreen brand. It can come from brands that capture a broader spectrum of health-conscious consumers and operate in non-competing spaces. The company sells a healthy lifestyle, and salads are simply how they do that today, with more possibilities in the future.

Final Thoughts

Sweetgreen has carved out a loyal and valuable niche in the fast casual market - high earning young professionals that live in urban city centers.

The location profile highlights this strategy, but also presents limitations on future growth. While they’ve been able to open ~200 locations to-date, the next 200 may be much harder to find.

As such, movement into new categories with that customer (high-end breakfast, smoothies / clean juices) or consolidating the market through acquisition might be needed to reach their goal of ~1,000 locations by 2030.